AI Data Centers Market Size Expected to Reach USD 165.73 Billion by 2034 Driven by Rising Computational Power Demand and Generative AI Expansion

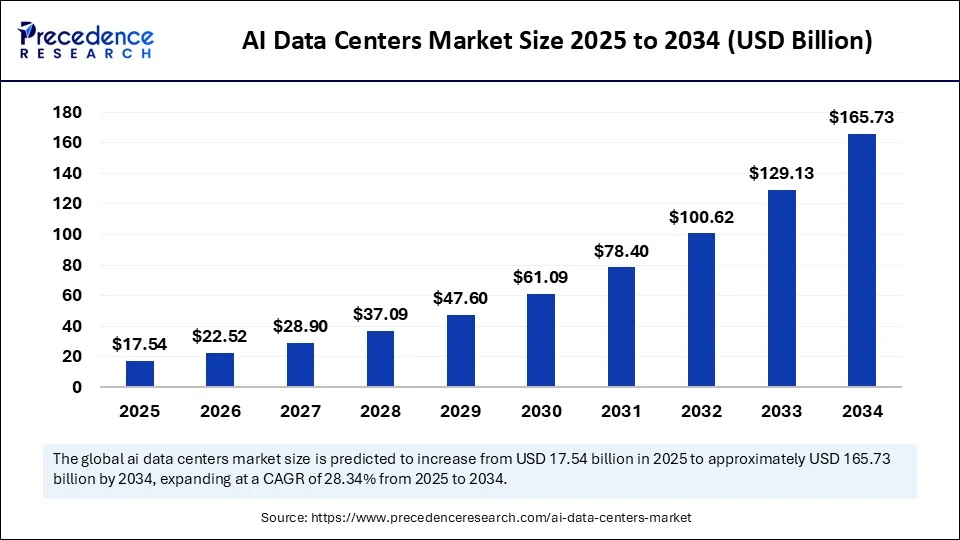

The global AI data centers market size is expected to reach nearly USD 165.73 billion by 2034 increasing from USD 17.54 billion in 2025 and accelerating at a solid CAGR of 28.34% from 2025 to 2034.

Ottawa, Sept. 10, 2025 (GLOBE NEWSWIRE) -- According to Precedence Research, the global AI data centers market size is valued at USD 17.54 billion in 2025 and is predicted to rise from USD 22.52 billion in 2026 to approximately USD 165.73 billion by 2034.

In terms of CAGR, the market is expected to expand at a compound annual growth rate (CAGR) of 28.34% between 2025 and 2034. The AI data centers market is driven by the growing need for AI-powered applications.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/6494

AI Data Centers Market Overview

The AI data center market is significant because it offers the essential infrastructure for the rapidly expanding artificial intelligence industry, fueling advancements in numerous sectors via massive data processing and computational power. AI data centers act as the backbone of the digital economy, offering the immense computational power as well as storage necessary for training and deploying AI models. AI-optimized data centers can significantly decrease energy consumption as well as operating expenses through intelligent management of cooling systems and resource allocation.

Real-time monitoring and dynamic workload management enhance overall data center performance as well as service delivery. AI contributes to enhanced data center security via real-time anomaly detection along with proactive threat identification.

AI Data Centers Market Key Highlights:

- In terms of revenue, the AI data centers market surpassed USD 13,670 million in 2024.

- It is projected to exceed over USD 165,730 billion by 2034.

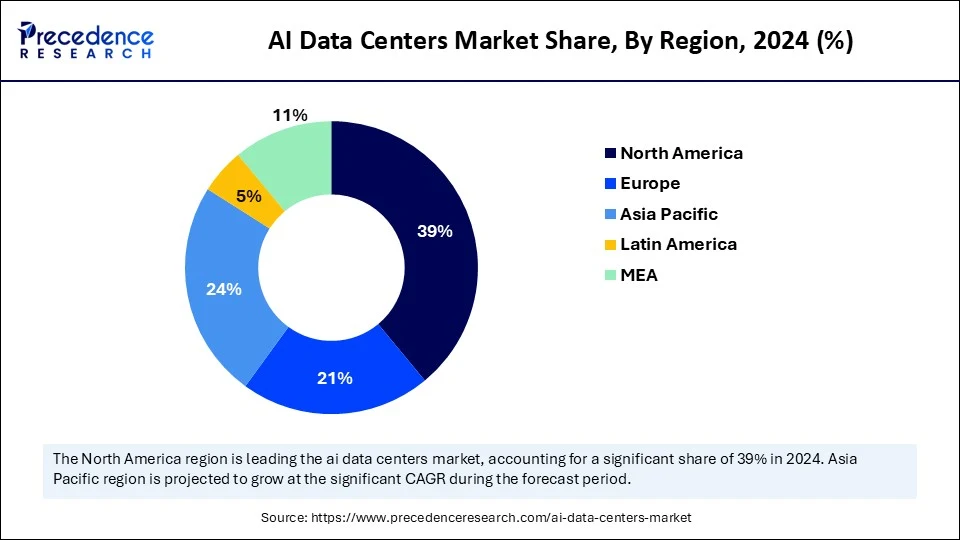

- North America dominated market by holding more than 39% of market share in 2024.

- Asia Pacific is expected to grow at a strong CAGR from 2025 to 2034.

- By component, the hardware segment held the major market share of 58% in 2024.

- By component, the services segment is growing at the fastest CAGR between 2025 and 2034.

- By data center type, the hyperscale AI data centers segment contributed the highest market share of 64% in 2024.

- By data center type, the edge AI data centers segment is expanding at a notable CAGR between 2025 and 2034.

- By AI workload type, the training workloads segment accounted for the largest market share of 45% in 2024.

- By AI workload type, the generative AI segment is registering a significant CAGR between 2025 and 2034.

- By cooling infrastructure, the air cooling segment generated the highest market share of 62% in 2024.

- By cooling infrastructure, the liquid cooling segment is growing at a healthy CAGR between 2025 and 2034.

- By power capacity, the 20–50 MW segment held the largest market share of 36% in 2024.

- By power capacity, the above 50 MW segment will grow at a CAGR between 2025 and 2034.

- By deployment mode, the cloud-based segment accounted for a significant market share of 52% in 2024.

- By deployment mode, the hybrid cloud segment will expand to a remarkable CAGR between 2025 and 2034.

- By end-user industry, the technology & cloud providers segment held the major market share of 48% in 2024.

- By end-user industry, the healthcare & life sciences segment will expand at a significant CAGR between 2025 and 2034.

Key Trends in the AI Data Centers Market

-

AI-Driven Infrastructure Expansion: Soaring demand for AI workloads, particularly from generative AI and large language models, is driving large-scale construction of AI-optimized data centers with high-density graphic processing units (GPU) and advanced storage systems.

-

Advanced Cooling Technologies: Traditional air cooling has peaked in efficacy—liquid cooling solutions like direct-to-chip and immersion systems are becoming mainstream to manage thermal load efficiently in AI-intensive environments.

-

Sustainability and Green Energy Integration: There's a heavy push for eco-friendly operations—facilities are adopting renewable energy, waste-heat reuse, energy-efficient designs, and pursuing carbon neutrality as standard practice.

-

Modular & Edge Data Center Designs: Pre-fabricated modular data centers and edge facilities are gaining traction, offering rapid deployment, lower latency, and scalable infrastructure close to users.

-

Automation & AIOps-Driven Management: AI-powered operations (AIOps) are increasingly used for predictive maintenance, real-time monitoring, anomaly detection, and efficient resource allocation to lower downtime and operating costs.

- Power Infrastructure & Grid Resilience: With AI systems consuming vast amounts of energy, data centers are increasingly relying on decentralized energy systems, microgrids, and modernized power infrastructure to ensure stability.

Dive Deeper – Get the Complete Report https://www.precedenceresearch.com/ai-data-centers-market

AI Data Centers Market Opportunity

Why is surging demand for computational power acting as an opportunity for the AI data centers market?

The surging demand for computational power is creating a major opportunity for the AI data center market as organizations increasingly depend on advanced AI models, high-performance applications, and big data analytics. These workloads need massive processing capacity, low-latency storage, along with scalable infrastructure.

AI data centers offer specialized hardware together with optimized systems needed to manage such demands, driving investment in GPUs, TPUs, along with energy-efficient solutions. This trend positions AI data centers as vital enablers of digital transformation globally.

AI Data Centers Market Key Challenge:

How are power availability and the strain on electrical grids a challenge for the AI data centers market?

Power availability and grid strain are major challenges for the AI data center market because AI's immense along with unpredictable power requirements outpace the electrical grid's capacity to supply along with manage power. The sheer scale of AI-driven need can overwhelm existing grid infrastructure, contributing to localized bottlenecks and requiring massive, time-consuming updates to transmission and distribution systems.

Data centers must be located in areas with robust power along with grid availability but planning as well as building new high-voltage transmission infrastructure can take five to ten years or more, a slow pace in comparison to data center deployment.

AI Data Centers Market Report Coverage

| Report Attributes | Key Statistics |

| U.S. Market Size in 2025 | USD 4,790 Million |

| U.S. Market Size by 2034 | USD 46,150 Million |

| Global Market Size in 2024 | USD 13.67 Billion |

| Global Market Size in 2025 | USD 17.54 Billion |

| Global Market Size by 2034 | USD 165.73 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 28.34% |

| Dominating Region in 2024 | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Data Center Type, AI Workload Type, Cooling Infrastructure, Power Capacity, Deployment Mode, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players Covered | NVIDIA Corporation, AMD (Advanced Micro Devices), Intel Corporation, Broadcom Inc., Micron Technology, Marvell Technology, Samsung Electronic, SK hynix Inc., TSMC (Taiwan Semiconductor Manufacturing Company), Supermicro (Super Micro Computer, Inc.), Dell Technologies, Hewlett-Packard Enterprise (HPE), Lenovo Group Ltd., Inspur Group, Cisco Systems, Inc., Arista Networks, Equinix, Inc. (data center infrastructure & interconnection), Vertiv Holdings Co. (power & cooling systems), Eaton Corporation, and Huawei Technologies Co., Ltd. |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

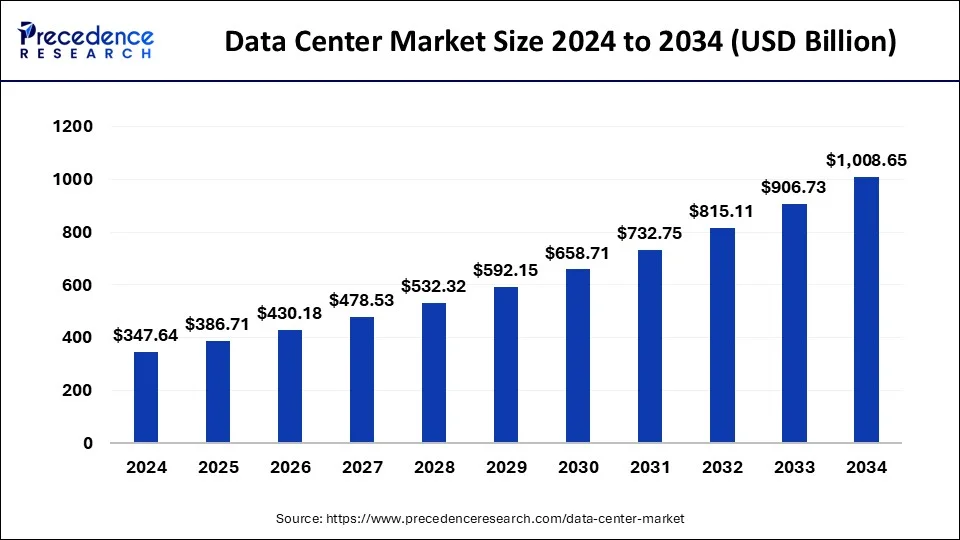

From Data Centers to AI Data Centers: Understanding the Bigger Picture

The AI data center industry represents one of the fastest-growing segments within the expansive global data center market. According to Precedence Research, the global data center market size was calculated at USD 347.64 billion in 2024 and is estimated to grow from USD 386.71 billion in 2025 to nearly USD 1,008.65 billion by 2034, with a CAGR of 11.24% from 2025 to 2034, fueled by the accelerating demand for cloud computing, edge services, big data analytics, and enterprise digital transformation. Data centers act as the core infrastructure of the digital economy, enabling seamless connectivity, data storage, and computational power for businesses and consumers alike.

The broader data center market includes hyperscale, colocation, enterprise, and edge facilities, each playing a critical role in meeting diverse enterprise needs. Hyperscale data centers dominate due to their scale and efficiency, while edge centers are expanding rapidly to support low-latency applications such as internet of things (IoT), 5G, and autonomous technologies. Colocation centers remain attractive for enterprises seeking cost-effective infrastructure without the burden of full ownership.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/3531

Several factors are driving this expansion:

- Cloud adoption across industries: Enterprises are migrating workloads to cloud environments, demanding robust and scalable infrastructure.

- 5G and IoT growth: Billions of connected devices require faster processing and localized storage, spurring investment in edge facilities.

- Digital transformation: Healthcare, BFSI, retail, government, and telecom are all expanding data center reliance.

- Sustainability focus: Operators are investing in renewable energy integration, carbon-neutral designs, and efficient cooling systems to align with ESG goals.

Within this landscape, AI data centers emerge as a transformational frontier. Unlike traditional facilities, they are purpose-built to handle high-density GPU workloads, generative AI models, and advanced training/inference tasks, placing new demands on power capacity, cooling, and network architecture. This makes AI data centers not just a subset but a catalyst shaping the evolution of the broader market.

Data Center Market Key Takeaways

- North America dominated the global market with the largest market share of 41% in 2024.

- Asia Pacific is estimated to expand at the fastest CAGR between 2025 and 2034.

- By component, the solution segment has held the largest market share of 65.76% in 2024.

- By component, the services segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By type, the hyperscale segment is expected to expand at the fastest CAGR over the projected period.

- By enterprise size, the small & medium enterprises segment is expected to expand at the fastest CAGR over the projected period.

- By end-user, the BFSI segment had the largest market share in 2024.

- By end-user, the IT & telecom segment is expected to expand at the fastest CAGR over the projected period.

Data Center Market Key Players

- Equinix, Inc.

- Digital Realty Trust, Inc.

- NTT Ltd.

- Global Switch Ltd.

- CyrusOne Inc.

- Interxion: A Digital Realty Company

- China Telecom Corporation Limited

- China Unicom (Hong Kong) Limited

- AT&T Inc.

- Amazon Web Services, Inc. (AWS)

- Microsoft Corporation

- Google LLC

- IBM Corporation

- Oracle Corporation

- Cisco Systems, Inc.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3531

AI Data Centers Market Key Regional Analysis

How did North America Dominate the AI Data Centers Market?

The region, mainly the United States and Canada, has a highly developed technological infrastructure that supports and fuels the expansion of artificial intelligence (AI). Major technology companies such as Microsoft along with Google allocate substantial resources to AI, while venture capital funding supports innovative startups. This influx of talent is vital for developing and implementing cutting-edge AI technologies.

- In July 2025, the U.S. Department of Energy (DOE) announced a new step on the Donald Trump administration’s plan for accelerating the development of AI infrastructure by siting on DOE lands. The DOE has selected its four sites, such as Idaho National Laboratory, Oak Ridge Reservation, Paducah Gaseous Diffusion Plant, and Savannah River Site, while inviting private sector partners for the development of advanced AI data centers and energy generation projects. (Source: https://www.energy.gov)

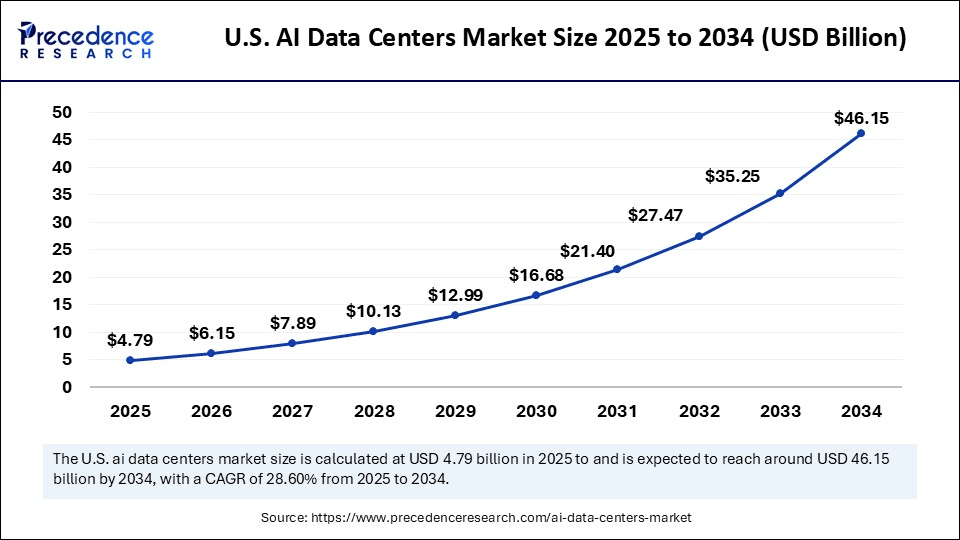

How Big is the U.S. AI Data Centers Market?

The U.S. AI data centers market was valued at USD 3.73 billion in 2024 and is projected to surpass USD 46.15 billion by 2034, expanding at a double-digit CAGR of 28.60% from 2025 to 2034.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/checkout/6494

Asia Pacific AI Data Centers Market Trends:

The Asia-Pacific is the fastest-growing region for AI data centers due to surging cloud adoption, a large and increasing population with increasing digital needs, government-supported AI strategies, growing data sovereignty concerns, and favorable factors such as abundant land and energy resources in some countries.

Countries such as Singapore, Hong Kong, and Tokyo offer strong infrastructure along with business-friendly environments. Additionally, nations like Malaysia and Thailand are leveraging their land along with energy resources to become attractive locations for large-scale data center development.

Europe AI Data Centers Market Trends

Europe is emerging as one of the most dynamic regions in the global AI data centers market, fueled by rapid digitalization, IoT adoption, and a surging demand for cloud computing solutions. The region has positioned itself as a hub for sustainable and green technology initiatives, with governments and enterprises alike prioritizing renewable energy integration, carbon-neutral designs, and next-generation energy-efficient architectures.

One of the defining characteristics of Europe’s AI data center landscape is the dominance of hyperscalers, who control the majority of capacity and continue to invest in expanding large-scale facilities. By 2025, these hyperscale projects are expected to introduce significant advancements in performance, scale, and sustainability, setting new global benchmarks for data center innovation.

Key markets such as the UK, Germany, and France are driving this momentum:

- United Kingdom: Supported by the government’s National AI Strategy, the UK is leveraging policy support and strong digital transformation initiatives to lead in AI-enabled infrastructure.

- Germany: With its robust data center ecosystem and emphasis on both digital transformation and sustainability, Germany continues to attract large-scale hyperscaler investments.

-

France: Backed by the AI for Humanity strategy, France is positioning itself as a frontrunner in ethical AI development and cutting-edge data center deployments.

Recent government and private-sector commitments further highlight Europe’s aggressive push. In January 2025, the European government unveiled its AI Opportunities Action Plan, designed to accelerate economic growth by aligning AI development with industrial strategy and innovation funding. Meanwhile, in February 2025, France announced a landmark €109 billion investment in its AI sector, bolstered by additional funding commitments of €30 billion and €50 billion from the UAE, earmarked for building a 1-gigawatt AI-optimized data center — a facility nearly four times the scale of the UK’s largest operational site.

Such record-breaking investments underscore Europe’s ambition not only to strengthen its AI capabilities but also to redefine global standards for sustainable and high-capacity AI data centers.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

AI Data Centers Market Segmentation Analysis

Component Analysis

The hardware segment dominated the AI data centers market in 2024, because AI workloads need massive computational power, high-speed data processing, together with low-latency performance. Specialized hardware such as GPUs, TPUs, and ASICs significantly accelerate training as well as inference tasks compared to conventional CPUs.

Additionally, increasing deployment of high- performance servers, networking infrastructure, and advanced storage systems, to manage exponential data growth thus strengthened hardware’s role. Investments in energy-efficient, scalable hardware solutions have made it the backbone of AI-driven data centers, by ensuring efficiency and speed.

Data Center Type Analysis

The hyperscale AI data centers segment dominated the AI data centers market in 2024, because they offer the immense computing power, huge storage, high-throughput networking, and improved infrastructure necessary for large-scale AI model training as well as deployment, providing critical scalability, cost-efficiency, as well as performance that other data center types cannot match. By operating at such a large scale, hyperscalers achieve economies of scale that make AI computing more cost-effective for the many organizations utilizing their cloud platforms.

Hyperscale data centers can efficiently manage a wide range of AI workloads, from deep learning along with generative AI to real-time analytics, making them base to current enterprise and cloud AI strategies.

AI Workload Type Analysis

The training workloads segment dominated the AI data centers market in 2024, because developing sophisticated AI models, mainly large language models as well as deep learning algorithms, need massive computational power, specialized hardware such as GPUs, and vast datasets, making these training processes greatly intensive. Companies are investing heavily in dedicated AI data centers as well as GPU clusters to perform these initial training runs along with shortening the development cycle, creating a surge in need for AI-ready infrastructure.

Cooling infrastructure Analysis

The air-cooling segment dominated the AI data centers market in 2024, due to its cost-effectiveness, established infrastructure, and wide availability. Most existing data centers were already programmed for air cooling, making adoption easier as well as cheaper compared to liquid systems. It provides simpler installation, maintenance, as well as scalability for moderate workloads. Moreover, many operators prioritized proven, reliable methods to quickly expand for AI expansion, delaying investment in more complex liquid cooling solutions even with their higher efficiency for extreme performance demands.

Power capacity Analysis

The 20–50 MW segment dominated the AI data centers market in 2024, because it strikes an equilibrium between scalability and efficiency. These facilities offer sufficient power to manage advanced AI workloads, which includes training large models, while improving energy use and cost. Their flexibility makes them ideal for hyperscalers as well as enterprises expanding AI capabilities.

Deployment Mode Analysis

The cloud-based segment dominated the AI data centers market in 2024, because decreased upfront expenses, superior scalability for fluctuating AI workloads, access to developed AI services such as pre-built models and APIs, as well as the convenience of managed infrastructure provided by major providers like Azure, AWS, and Google Cloud. Cloud providers provide a comprehensive suite of ready-to-use AI tools, including natural language processing (NLP), machine learning models, as well as computer vision APIs, permitting organizations to develop AI solutions faster.

End-user Industry Analysis

The technology & cloud service providers segment held the largest share in the AI data centers market in 2024, because the rising reliance on cloud infrastructure for digital transformation, AI advancements, as well as the expansion of Software as a Service (SaaS) solution across numerous industries. Businesses are increasingly accepting cloud solutions to modernize operations, improve customer engagement, and enhance agility. Amazon Web Services (AWS), Google Cloud, and Microsoft Azure are the dominant players, while the Asia-Pacific region shows significant expansion for SaaS offerings.

AI Data Centers Market Top Companies

The AI Data Centers Market is dominated by key industry leaders whose strong market share and strategic initiatives shape the future direction of the industry.

-

NVIDIA Corporation: Powers AI data centers with industry-leading GPUs and AI infrastructure platforms like NVIDIA DGX and Grace Hopper systems.

-

AMD (Advanced Micro Devices): Offers high-performance CPUs and GPUs tailored for AI workloads, cloud environments, and hyperscale data centers.

-

Intel Corporation: Provides data center processors, AI accelerators, and scalable compute solutions through its Xeon and Habana Labs product lines.

-

Broadcom Inc.: Delivers high-speed networking and connectivity solutions essential for modern AI data center architectures.

-

Micron Technology: Supplies advanced memory and storage products, including high-bandwidth DRAM and SSDs optimized for AI-driven operations.

-

Marvell Technology: Specializes in custom silicon, data processing units (DPUs), and cloud-optimized networking chips used in AI infrastructure.

-

Samsung Electronics: Develops cutting-edge memory and processing technologies vital for high-speed AI training and inference in data centers.

Recent Developments:

- In September 2025, Micron Technology, Inc. is proud to declare its commitment to the White House’s Pledge to America’s Youth: Investing in AI Education, a national initiative targeted at preparing young Americans to contributed to an AI-powered future. (Source https://investors.micron.com)

- In April 2025, Dell Technologies will start advancements across its industry-leading server, storage, along with data protection portfolios programmed to help organizations achieve data center modernization. (Source: https://www.dell.com

- In November 2024, Inspur Cloud Services together with Cyperport signed a Memorandum of Understanding (MoU) for the advancement of artificial intelligence (AI) infrastructure in Hong Kong. (Source: https://www.datacenterdynamics.com)

AI Data Centers Segments Covered in the Report

By Component

- Hardware

- Compute (GPUs, CPUs, TPUs, ASICs)

- Memory (HBM, DRAM, Flash)

- Storage (NVMe SSD, HDD, Object Storage)

- Networking (Switches, Routers, Interconnects)

- Software

- AI Workload Management Platforms

- Orchestration Tools (e.g., Kubernetes for AI)

- Virtualization & Containerization Software

- AI Model Training/Inference Frameworks

- Services

- Deployment & Integration

- Managed Services

- Consulting & Support

By Data Center Type

- Hyperscale AI Data Centers

- Colocation AI Data Centers

- Edge AI Data Centers

- Enterprise (Private) AI Data Centers

By AI Workload Type

- Training Workloads

- Inference Workloads

- Real-Time Analytics

- Generative AI

- Reinforcement Learning

By Cooling Infrastructure

- Liquid Cooling

- Immersion Cooling

- Direct-to-Chip Liquid Cooling

- Air Cooling

- CRAH/CRAC Units

- Chilled Water Systems

- Hybrid Cooling Systems

By Power Capacity

- Below 5 MW

- 5–20 MW

- 20–50 MW

- Above 50 MW

By Deployment Mode

- On-Premises

- Cloud-Based

- Hybrid Cloud

By End-User Industry

- Technology & Cloud Service Providers

- BFSI

- Healthcare & Life Sciences

- Automotive (Autonomous Driving)

- Retail & E-commerce

- Government & Defense

- Telecom

- Energy & Utilities

- Education & Research

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/6494

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ Data Center Construction Market:

- The global data center construction market size was estimated at USD 240.72 billion in 2024 and is anticipated to reach around USD 491.99 billion by 2034, expanding at a CAGR of 7.41% from 2025 to 2034.

➡️ AI Server Market:

- The global AI server market size is predicted to reach around USD 352.28 billion by 2034, increasing from USD 30.74 billion in 2024, with a CAGR of 27.62% from 2025 to 2034.

➡️ Data Center Transformation Market:

- The global data center transformation market size was valued at USD 11.63 billion in 2024 and is anticipated to reach around USD 29.15 billion by 2034, growing at a CAGR of 9.62% from 2025 to 2034.

➡️ AI in Networks Market

- The global AI in networks market size was estimated at USD 11.53 billion in 2024 and is predicted to increase from USD 15.28 billion in 2025 to approximately USD 192.42 billion by 2034, expanding at a CAGR of 32.51% from 2025 to 2034.

➡️ Edge Data Center Market

- The global edge data center market size accounted for USD 15.46 billion in 2024 and is expected to be worth around USD 84.41 billion by 2034, at a CAGR of 18.50% from 2025 to 2034.

➡️ Data Analytics Market:

- The global data analytics market size is estimated at USD 50.04 billion in 2024 and is anticipated to reach around USD 658.64 billion by 2034, expanding at a CAGR of 29.40% from 2025 to 2034.

➡️ Data Center Infrastructure Management (DCIM) Market:

- The global data center infrastructure management (DCIM) market size was estimated at USD 3.19 billion in 2024 and is predicted to increase from USD 3.67 billion in 2025 to approximately USD 13.10 billion by 2034, expanding at a CAGR of 15.17% from 2025 to 2034.

➡️ Data Center Outsourcing Market:

- The global data center outsourcing market size was estimated at USD 133.97 billion in 2024 and is predicted to increase from USD 140.72 billion in 2025 to approximately USD 218.23 billion by 2034, expanding at a CAGR of 5.00% from 2025 to 2034.

➡️ Data Center Solutions Market:

- The global data center solutions market size accounted for USD 27.95 billion in 2024 and is predicted to increase from USD 31.83 billion in 2025 to approximately USD 100.58 billion by 2034, expanding at a CAGR of 13.66% from 2025 to 2034.

➡️ Micro Data Center Market:

- The global micro data center market size was estimated at USD 7.48 billion in 2024 and is predicted to increase from USD 9.65 billion in 2025 to approximately USD 88.36 billion by 2034, expanding at a CAGR of 28.01% from 2025 to 2034.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.