Hydrogen Energy Storage Market Size to Exceed USD 34.56 Billion by 2034 Driven by Green Hydrogen Investments and Decarbonization Efforts

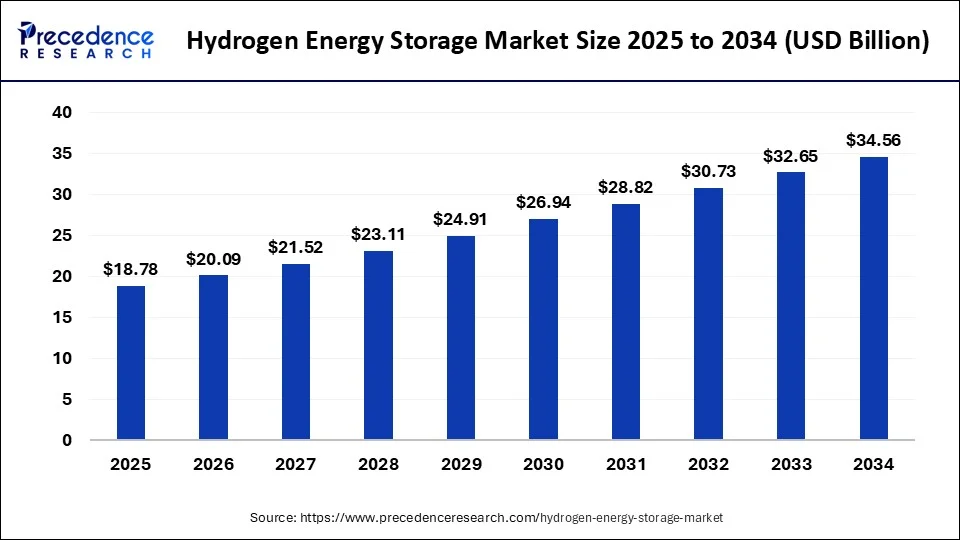

According to Precedence Research, the global hydrogen energy storage market size will grow from USD 18.78 billion in 2025 to nearly USD 34.56 billion by 2034, with a solid CAGR of 7.01%. Backed by green hydrogen initiatives, advanced storage technologies, and rising demand from transportation and industry, the sector is positioned for strong long-term growth.

Ottawa, Sept. 17, 2025 (GLOBE NEWSWIRE) -- The global hydrogen energy storage market size is projected to exceed USD 34.56 billion by 2034, growing from USD 18.78 billion in 2025. The market is expanding at a notable CAGR of 7.01% from 2025 to 2034. The market is propelled by the increased need to integrate renewable energy, decarbonization efforts, and hydrogen production and storage technologies.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1661

Hydrogen Energy Storage Market Key Highlights

- In terms of revenue, the hydrogen energy storage market was valued at USD 17,590 million in 2024.

- It is expected to be more than USD 34,560 million by 2034.

- The market is expected to expand at a CAGR of 7.01% from 2025 to 2034.

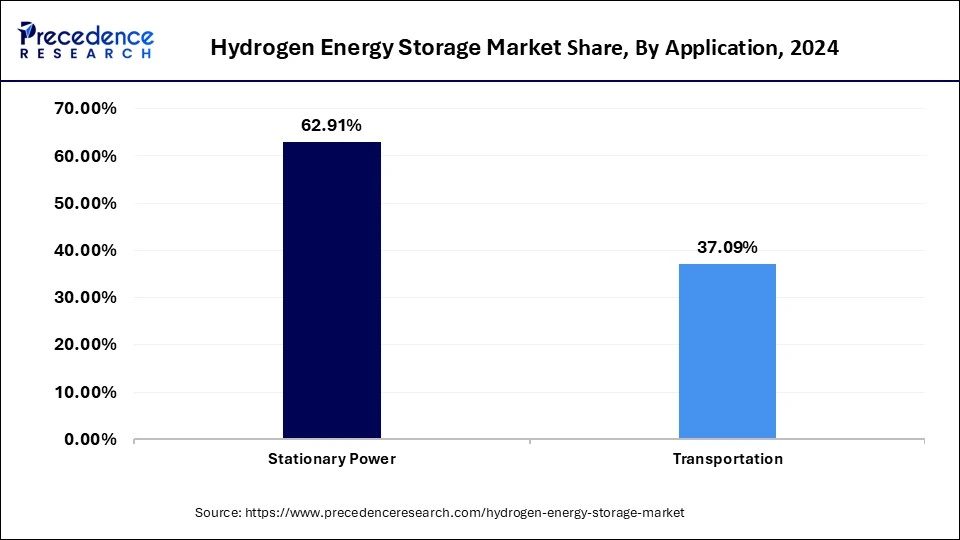

- By application, the transportation segment held a significant share in 2024.

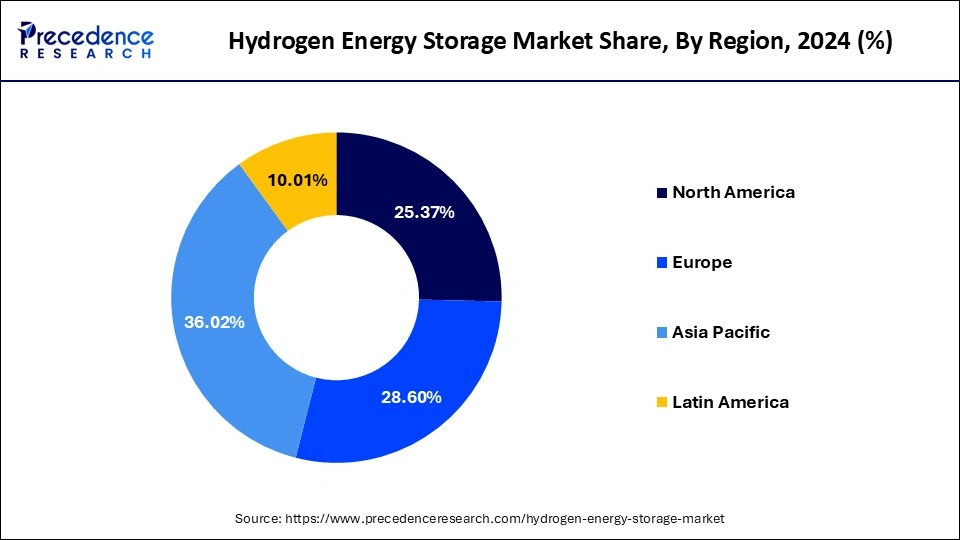

- Asia Pacific led the global market with the highest market share of 36.02% in 2024.

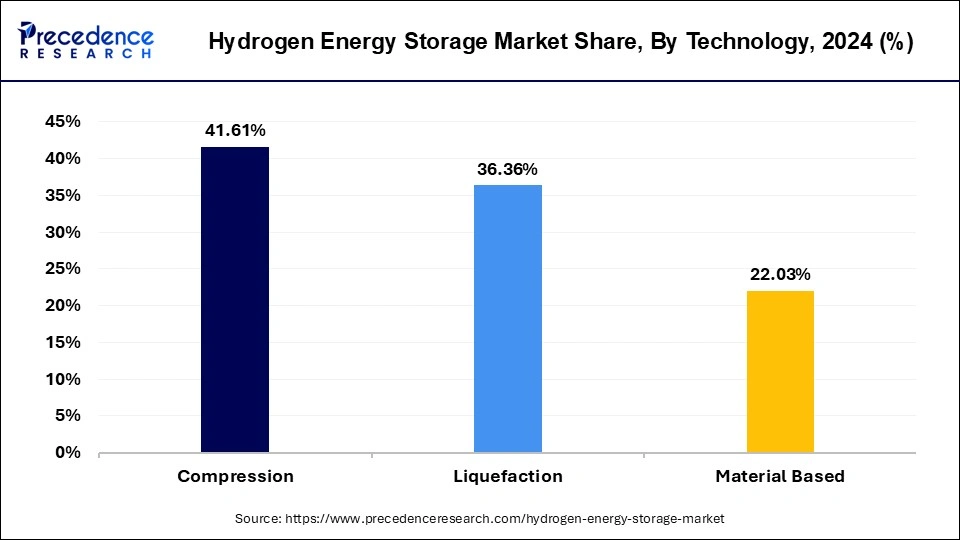

- By Technology, the compression storage technology segment has held the largest market share of 41.61% in 2024.

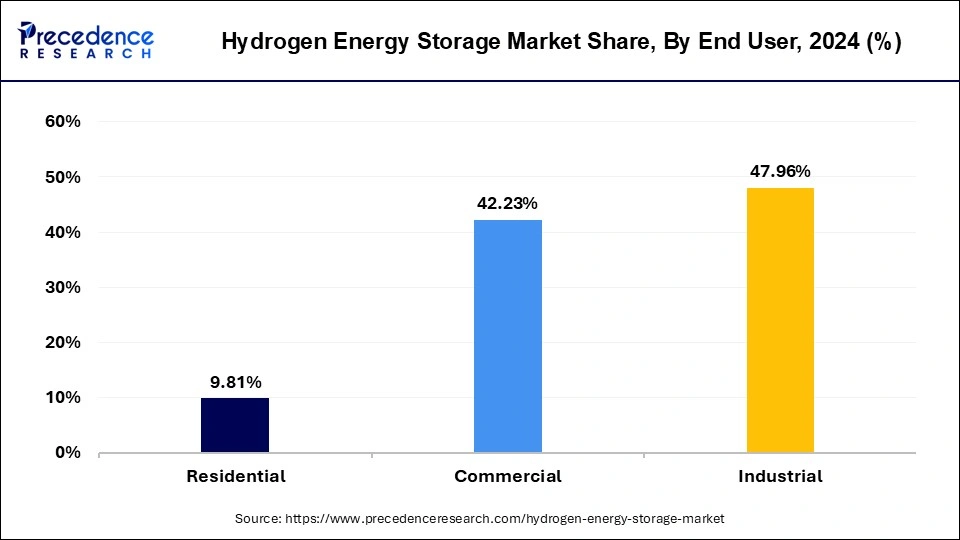

- By End User, the industrial segment captured the biggest revenue share of 47.96% in 2024.

- By Physical State, the solid segment is estimated to hold the highest market share of 41.76% in 2024.

Hydrogen Energy Storage Market Size by Application, 2022 to 2024 (USD Million)

| By Application | 2022 | 2023 | 2024 |

| Stationary Power | 9,760.59 | 10,389.15 | 11,066.82 |

| Transportation | 5,835.78 | 6,169.07 | 6,525.92 |

Hydrogen Energy Storage Market Size by Technology, 2022 to 2024 (USD Million)

| Technology | 2022 | 2023 | 2024 |

| Compression | 6,533.88 | 6,913.08 | 7,319.76 |

| Liquefaction | 5,685.69 | 6,028.65 | 6,397.15 |

| Material Based | 3,376.80 | 3,616.50 | 3,875.83 |

Hydrogen Energy Storage Market Size by End User, 2022 to 2024 (USD Million)

| End User | 2022 | 2023 | 2024 |

| Residential | 1,550.71 | 1,635.28 | 1,725.69 |

| Commercial | 6,507.44 | 6,951.04 | 7,430.24 |

| Industrial | 7,538.22 | 7,971.90 | 8,436.81 |

Hydrogen Energy Storage Market Size by Physical State, 2022 to 2024 (USD Million)

| Physical State | 2022 | 2023 | 2024 |

| Solid | 6,571.57 | 6,945.54 | 7,346.23 |

| Liquid | 5,113.97 | 5,461.84 | 5,837.59 |

| Gas | 3,910.83 | 4,150.84 | 4,408.92 |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1661

Hydrogen Energy Storage Market Overview

What is Hydrogen Energy Storage?

The hydrogen energy storage is showing a strong growth due to the increasing global move towards clean energy and carbon neutrality. As the use of renewable energy sources like solar and wind energy continues to rise, the need to have effective energy storage systems is on the rise to counter intermittency to ensure stability in the grid. Also, favorable government policies, increased investments in the field of green hydrogen, and the development of electrolyzer and fuel cell technologies are driving the development of the market.

The hydrogen versatility in power production, transportation, and industry also increases its implementation, especially in the hard-to-decarbonize industries, such as steel, cement, and chemicals. As the world moves towards greater emphasis on sustainable infrastructure and net-zero ambitions, hydrogen energy storage is becoming a foundation of the clean energy transformation.

Which are the Latest Government Initatives for Hydrogen Enegry Storage?

1. United States – Clean Hydrogen Hubs Initiative

The U.S. Department of Energy (DOE) has committed up to $2.2 billion to establish the Gulf Coast and Midwest Regional Clean Hydrogen Hubs (H2Hubs). These hubs aim to accelerate the commercial-scale deployment of low-cost, clean hydrogen, creating tens of thousands of high-quality jobs and reinforcing America's clean manufacturing sector

2. India – National Green Hydrogen Mission (NGHM)

India's NGHM, launched by the Ministry of New and Renewable Energy (MNRE), focuses on large-scale green hydrogen production, storage, and utilization. The mission includes setting up green hydrogen hubs, promoting decentralized production methods, and offering financial support for research and development projects. It aims to position India as a global leader in green hydrogen technology.

3. United Kingdom – Clean Flexibility Roadmap

The UK government has introduced the Clean Flexibility Roadmap, which includes the development of business models for hydrogen production, transport, and storage. This initiative supports the delivery of hydrogen-fired power as part of the Clean Power 2030 Mission and aims to establish the UK's first regional hydrogen transport and storage network by 2031.

4. India – Strategic Interventions for Green Hydrogen Transition (SIGHT) Programme

Under the SIGHT programme, the Indian government has awarded 412,000 tonnes per annum (TPA) of green hydrogen production capacity and approved 3 GW of electrolyser manufacturing capacity per year. The programme aims to promote large-scale green hydrogen production, improve cost competitiveness, and facilitate rapid expansion.

5. India – Carbon Capture, Utilization, and Storage (CCUS) Programme

The Indian government is preparing a CCUS programme with an estimated cost of ₹38,900 crore. The scheme is expected to be implemented in phases and will involve the Centre contributing a little more than half of the total funding. This initiative reflects India's commitment to reducing carbon emissions and combating climate change through advanced technology in capturing and storing CO₂ emissions from industrial and energy sectors.

➤ Get the Full Report @ https://www.precedenceresearch.com/hydrogen-energy-storage-market

Hydrogen Energy Storage Market Trends

- Integration with Renewable Energy: Growing use of hydrogen storage to balance intermittent solar and wind power, enhancing grid stability and enabling 24/7 clean energy supply.

- Green Hydrogen Production Expansion: Increasing investment in electrolyzers powered by renewable sources to produce green hydrogen, reducing carbon footprint in storage solutions.

- Scaling Up Infrastructure: Rapid development of hydrogen refueling stations, large-scale storage facilities, and pipelines to support industrial, transport, and residential demand.

- Technological Innovation: Advances in materials (e.g., composites for high-pressure tanks), solid-state storage, and cost-efficient electrolyzers improving safety, efficiency, and storage capacity.

- Sector Coupling and Decarbonization: Hydrogen storage is increasingly being used to link power, industry, transport, and heating sectors, supporting wider decarbonization efforts.

- Emergence of Hydrogen Hubs: Development of regional hydrogen hubs that integrate production, storage, distribution, and end-use applications to create efficient hydrogen ecosystems.

-

Global Collaboration and Supply Chains: Growing international partnerships and trade agreements to develop cross-border hydrogen supply chains, boosting market scale and reducing costs.

Hydrogen Energy Storage Market Opportunity

What is an Opportunity for the Hydrogen Energy Storage Market?

Government support is one of the biggest opportunities in the market because the world is moving towards achieving carbon neutrality and the creation of sustainable energy systems. Policymakers are beginning to develop end-to-end policies, subsidies, and funds to hasten the research, development, and commercialization of hydrogen technologies.

The federal grants, tax credits, and public-private partnerships are actively funding infrastructure projects such as installing electrolyzers and storage sites, and the refueling network. Such investments reduce costs on the financial burden on the individual investor, as well as promote innovation and mass commercialization of hydrogen energy storage.

Hydrogen Energy Storage Market Challenges

What is the Limitation for the Hydrogen Energy Storage Market?

The constraint in the market is that it is capital-intensive to put up the required infrastructure. In order to have a full hydrogen economy, large investments in electrolyzers would be required to produce green hydrogen, high-pressure hydrogen storage tanks, liquefaction stations, and sophisticated distribution networks. These elements are based on advanced engineering, excellent safety devices, and expensive hi-tech materials, and the initial installation is especially costly. Moreover, the renewable-based electrolysis of hydrogen to generate green hydrogen is quite expensive as opposed to natural gas-produced hydrogen, which poses a competitive drawback.

Hydrogen Energy Storage Market Report Coverage

| Report Attributes | Statistics |

| Market Size in 2024 | USD 17.59 Billion |

| Market Size in 2025 | USD 18.78 Billion |

| Market Size in 2031 | USD 28.82 Billion |

| Market Size by 2034 | USD 34.56 Billion |

| Growth Rate 2025 to 2034 | CAGR of 7.01% |

| Leading Region in 2024 | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Physical State, End User, Application, and Region |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

| Key Players | Air Liquide, Steelhead Composites Inc., Air Products Inc., ITM Power, Iwatani Corporation, Nedstack Fuel Cell Technology BV, Cummins Inc., Engie, Nel ASA, Linde PLC,, and others. |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

How Asia Pacific Dominated the Hydrogen Energy Storage Market?

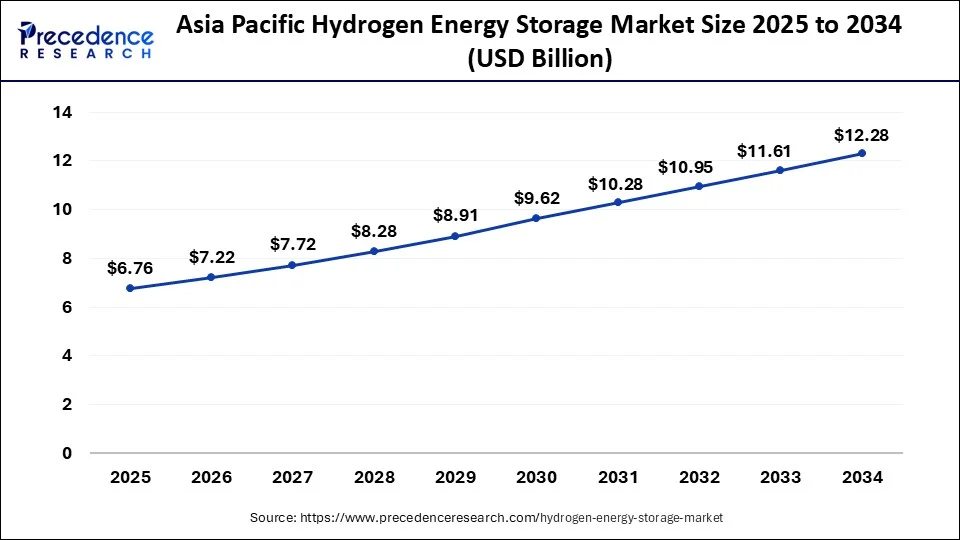

The Asia Pacific hydrogen energy storage market size was evaluated at USD 6.34 billion in 2024 and is predicted to surpass around USD 12.28 billion by 2034, expanding at a CAGR of 6.86% from 2025 to 2034.

Asia Pacific dominated the market in 2024, with the region taking more interest in controlling the issues of electricity shortages and ensuring that there are reliable sources of energy. Governments such as China, Japan, South Korea, and Australia, among others, are investing in hydrogen infrastructure as a part of their decarbonization plans and long-term clean energy plans. Japan and South Korea already have national hydrogen road maps, which involve promotion of the fuel cell vehicles, hydrogen-fueled industries, and large storage plans. Moreover, promising government policies and research activities, as well as international cooperation, are enhancing the strengths of hydrogen in the region.

China is a major player in the regional market due to its large-scale government-backed initiatives that integrate renewable energy production with hydrogen storage, robust financial support, and a comprehensive domestic supply chain that drives down costs. The country's strategic long-term policies, abundant renewable resources, and rapidly expanding demand across industries like transportation and steelmaking fuel rapid adoption and innovation in hydrogen storage technologies. Additionally, China’s investment in R&D, patent leadership, and development of integrated hydrogen infrastructure enable it to scale efficiently and compete globally, solidifying its leadership position in the region.

Why is North America the Fastest-Growing in the Hydrogen Energy Storage Market?

North America experiences the fastest growth in the market during the forecast period, because it has a well-developed industrial sector and an increased demand for green energy solutions. Canada and the U.S. have been leading in the development of hydrogen, which is backed by massive government financing, public-private collaboration, and tough emission policies that speed up the adoption of clean energy technologies. The increasing use of hydrogen in transportation, power generation, and heavy industries is also a factor that stimulates the market development. Moreover, the growing popularity of hydrogen storage tools among energy companies and utilities confirms the decarbonization of the region.

The U.S. is a leading player in the regional market due to substantial federal and state investments, strategic policy frameworks, and a robust industrial base. The Inflation Reduction Act (IRA) offers tax credits up to $3 per kilogram for clean hydrogen production, spurring over $50 billion in hydrogen-related commitments. The U.S. Department of Energy has also allocated $338 billion in 2025 for energy technologies, including hydrogen storage.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Hydrogen Energy Storage Market Segmentation

Application Analysis

Why did the Transportation Segment Dominate the Hydrogen Energy Storage Market?

In 2024, the transportation segment dominated the market, by generating part of the improved popularity of zero-emission mobility solutions. The conventional battery electric vehicles are disadvantaged in the long-range, long-utility, and heavy-duty segments, where the hydrogen fuel cell vehicles (FCV) outperform in terms of range, shorter refueling times, and increased efficiency. Governments all over the world are actively promoting hydrogen mobility by tax credits, financing fuel cell development, and accelerating rollouts of refueling stations.

The stationary power segment is the fastest-growing in the market during the forecast period, due to the rising demand for grid resiliency, as well as backup power. Hydrogen is a better, more sustainable, and scalable solution than diesel generators or lithium-ion batteries by providing long-duration, emission-free storage. Incentives and financial support for the introduction of hydrogen in energy systems are also being offered by governments and utilities, creating an impetus to use the fuel. Moreover, new technologies of improving the efficiency of electrolyzers, cost decreases, and increased storage densities are making hydrogen competitive.

Technology Analysis

Which Technology Segment Held the Largest Share of the Hydrogen Energy Storage Market?

The compression storage technology segment held the largest share in the hydrogen energy storage market in 2024, as it is the most commonly adopted and least expensive hydrogen storage mechanism. It is used in stationary and mobile applications in several industries because this technology can compress the hydrogen gas in high-pressure cylinders. It is popular because it has relatively lower infrastructure cost, simple design, and is easy to implement, compared to other advanced options like liquefaction or solid-state storage. Moreover, due to the constant improvement of the materials of high-pressure tanks and their safety measures, the reliability of the given method has increased, and its scalability has improved.

The liquefaction technology segment experiences the fastest growth in the market during the forecast period, mainly because of its capacity to store and transport hydrogen in high amounts. Through liquefaction, which is cooling the hydrogen to cryogenic temperatures, the liquid form of hydrogen becomes much smaller and is easier to manage in terms of transportation and storing bulk.

Also, increasing investment in hydrogen infrastructure, including liquefaction facilities and cryogenic storage facilities, is further boosting the uptake of this technology. Liquefaction is an important development driver, with industries and governments beginning to vigorously market the adoption of using more hydrogen as a component of decarbonization strategies, and it is therefore the fastest-growing aspect of the technology market.

End-User Analysis

How Industrial Segment Dominates the Hydrogen Energy Storage Market?

The industrial segment dominated the market in 2024. Hydrogen is one of the key necessities in steel, cement, chemical, and refining industries, as it is used as a feedstock and as a clean energy carrier to displace fossil fuels. Moreover, hydrogen is increasingly finding its way into the electricity production sector to energize industrial buildings, maintain its energy needs at the point of consumption, and enhance energy security. Increasing the adoption of hydrogen energy storage solutions by industries has been boosted by the prioritization of decarbonization of hard-to-abate industries by governments.

The commercial segment is the fastest-growing in the market during the forecast period. The increasing need for electricity and grid stability in numerous commercial buildings, including offices, shopping malls, data centers, and infrastructure development projects.

Hydrogen energy storage provides a reliable and long-term solution to power shortages, especially in regions with high power needs. In addition, the growing idea of sustainable buildings and smart infrastructure is also raising the utilization of clean energy storage in business facilities.

Physical State Analysis

Why did Solid Segment Hold the Largest Share of the Hydrogen Energy Storage Market?

The solid segment held the largest share in the market in 2024. The hydrogen is confined in substances like metal hydrides, chemical hydrides, or carbon-based structures, which can store greater energy density and be compacted when compared to gaseous or liquid forms. Compared to the hydrogen storage by liquid, the solid-state hydrogen storage systems minimize the risk of leakage, volatility, and high-pressure containment, and are applicable in stationary energy storage, transportation, and industrial applications. In addition, recent studies and technological advances in solid hydrogen storage materials have boosted cost efficiency, and they more commercially viable.

The liquid segment experiences the fastest growth in the market during the forecast period, due to its versatility and broad application in various industries. Liquid hydrogen provides greater energy density than gaseous hydrogen and is suited for the needs of applications with high energy requirements in a small volume, including the aerospace industry, marine industry, and heavy-duty transportation. The governments and companies invest in hydrogen supply chains and green hydrogen production, the liquid segment will expand quickly and may serve as a key catalyst for hydrogen energy in the future.

Hydrogen Energy Storage Market Top Companies

➢ Air Liquide – Air Liquide develops and operates hydrogen production and storage systems, including high-pressure tanks and cryogenic storage, to support mobility and industrial applications.

➢ Steelhead Composites Inc. – Steelhead Composites specializes in lightweight, high-pressure hydrogen storage vessels designed for stationary and mobile energy storage solutions.

➢ Air Products Inc. – Air Products provides advanced hydrogen fueling and storage infrastructure, including liquid and gaseous hydrogen storage technologies.

➢ ITM Power – ITM Power manufactures electrolyzers that generate green hydrogen, which can be stored on-site in pressurized systems for later energy use.

➢ Iwatani Corporation – Iwatani offers integrated hydrogen solutions including liquefied hydrogen storage and distribution systems for energy and transportation sectors.

➢ Nedstack Fuel Cell Technology BV – While primarily focused on fuel cells, Nedstack supports hydrogen energy systems that integrate with storage components for industrial backup and grid applications.

➢ Cummins Inc. – Cummins develops hydrogen storage systems as part of its hydrogen fuel cell and electrolyzer technology offerings for mobility and stationary power.

➢ Engie – Engie invests in large-scale hydrogen infrastructure projects, including storage facilities to enable renewable energy integration and grid balancing.

➢ Nel ASA – Nel ASA designs and delivers hydrogen production plants with integrated storage solutions for industrial, mobility, and energy applications.

➢ Linde PLC – Linde offers comprehensive hydrogen infrastructure, including advanced cryogenic and compressed gas storage technologies for a range of applications.

Hydrogen Energy Storage Market Recent Developments

- In July 2025, the 11th edition of India Energy Storag Week (IESW) 2025, wa organized by the Idnian Energy Storafe Alliance (IESA), with aim of invtsing Rs 8,000 crore in the energy storage fileds, electric vehicles (Evs), and green hydrogen. This eevnt was commenced with a rand inaugural ceremony at IICC Yashobhoomi, New Delhi. ( Source: https://www.gleaf.in)

- In March 2025, RWE entered into a 15-year agreement with TotalEnergies to supply approximately 30,000 tonnes of green hydrogen per year since 2030. This supply will be provided by the 300MW of electrolysis capacity in Lingen, Germany, which will start operating in 2027 to decarbonize the Leuna refinery of TotalEnergies. ( Source: https://www.rwe.com)

Hydrogen Energy Storage Market Segments Covered in the Report

By Technology

- Compression

- Liquefaction

- Material Based

By Physical State

- Solid

- Liquid

- Gas

By End User

- Residential

- Commercial

- Industrial

By Application

- Stationary Power

- Transportation

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1661

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ Energy Storage Technologies for Renewables Market: Explore how advanced storage solutions are enabling reliable, round-the-clock renewable power integration.

➡️ Pumped Hydro Storage Market: Understand how large-scale hydro storage systems are driving grid stability and long-term energy security.

➡️ Hydrogen Storage Tanks and Transportation Market: See how innovative storage and transport technologies are unlocking hydrogen’s role in the energy transition.

➡️ AI in Hydrogen Operations Market: Learn how AI-driven insights are optimizing hydrogen production, storage, and distribution efficiency.

➡️ Hydrogen Generation Market: Track how green, blue, and grey hydrogen pathways are reshaping the global energy ecosystem.

➡️ Hydrogen Aircraft Market: Discover how hydrogen-powered aviation is paving the way for zero-emission air travel.

➡️ Hydrogen Compressor Market: Analyze how advanced compression technologies are supporting hydrogen infrastructure scalability.

➡️ Hydrogen Internal Combustion Engines Market: Explore how hydrogen ICEs are bridging the gap between traditional engines and clean mobility.

➡️ Hydrogen Electrolyzer Market: Learn how cutting-edge electrolyzer technologies are powering green hydrogen production at scale.

➡️ Hydrogen Technology Testing Inspection and Certification Market: Understand how TIC services are ensuring safety, compliance, and reliability in hydrogen projects.

➡️ Thermochemical Energy Storage Market: Discover how thermochemical systems are enabling high-efficiency, long-duration energy storage solutions.

➡️ Blue Hydrogen Market: Track how carbon capture integration is driving the expansion of blue hydrogen as a transitional clean energy source.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.